Clear Communication Goals

- Fully funded on a Technical Provisions basis in 15 years.

- There will be no increase in contributions from currently committed levels over a 15 year period.

Business Continuity Planning for Covid-19. Learn more

Through the use of cutting-edge technology, our investment experts deliver a new level of cost and risk-reducing efficiencies to all schemes, no matter their size. Our approach can be used by you as a sponsor to either set investment strategy and present a proposal to the trustees, to carry out an independent assessment of any trustee proposals or to be used to set strategy working simultaneously with the trustees.

Our innovative approach focuses on three key areas.

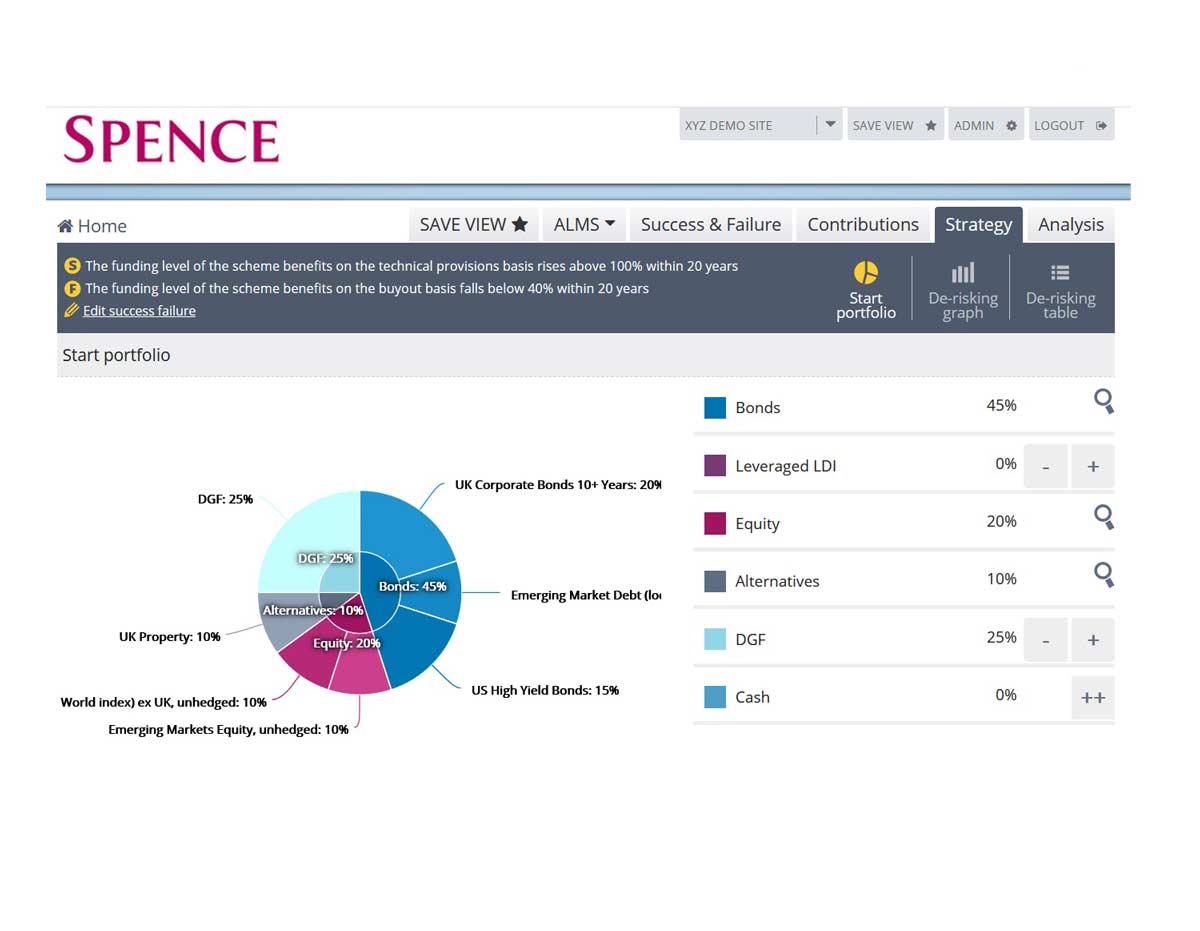

Our Advanced Asset Liability Modelling (ALM) tool assesses the performance of multiple candidate investment strategies based on thousands of economic scenarios, to provide a clear measure of their suitability.

We then work with you to explore many investment strategies to find their optimal chance of achieving your objectives.

The calculations are repeatable and delivered quarterly, which means ongoing detailed analysis can be carried out quickly at a very low cost.

This delivers significant added-value through time and cost efficiency savings for you.

True integration of administration, funding and investment means our modelling offers a level of validity that no other system on the market can provide. The automated modelling is based on:

Combined with our expert advice, you can now access an unparalleled framework for strategy planning and decision making.

Taking it one step further to ensuring schemes meet their ultimate objectives.

Spence & Partners Limited is authorised and regulated by the Financial Conduct Authority in the conduct of investment business.

Please contact Simon Cohen or fill out this form.

Distressed employers have a number of options when it comes to their defined benefit pension obligations.

Our defined contribution advisory practice delivers better member outcomes

Get in touch and we can pass it to the right department.

You have successfully been added to our newsletter(s).

There has been an error subscribing to our newsletters, please try again.