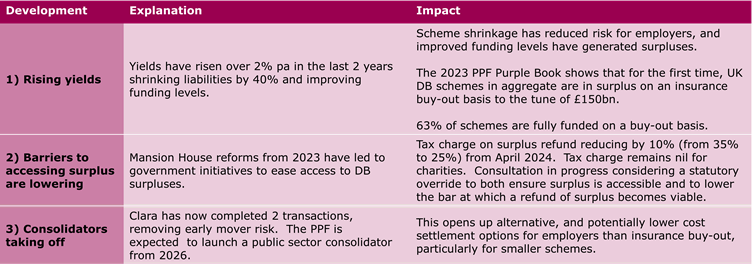

For years, employers have seen Defined Benefit (DB) schemes as a liability with unexpected costs and risks surfacing. But is the tide turning? Recent developments mean some employers could now see their DB scheme as an asset rather than a liability. These developments include:

What options have employers got?

Employers have 3 fundamental choices for their DB scheme:

- Settle with insurance buy-out: the traditional endgame is still likely to be favoured by most employers, but it is getting difficult to access competitive quotes at the smaller end of the market, and the settlement hit to the P&L can be unwelcome.

- Transfer to a consolidator: the concept is now better tested with 2 Clara transactions. The ‘connected covenant’ solution, whereby some or all of the sponsor remains attached to the scheme for a period of time, could widen the scope of this solution beyond distress cases. The PPF’s public sector consolidator will kick start this option for smaller schemes, irrespective of the covenant strength of the employer.

- Run-on: this is becoming increasingly compelling for employers with larger balance sheets that are already comfortable managing financial risk.

How much value could be generated with run-on?

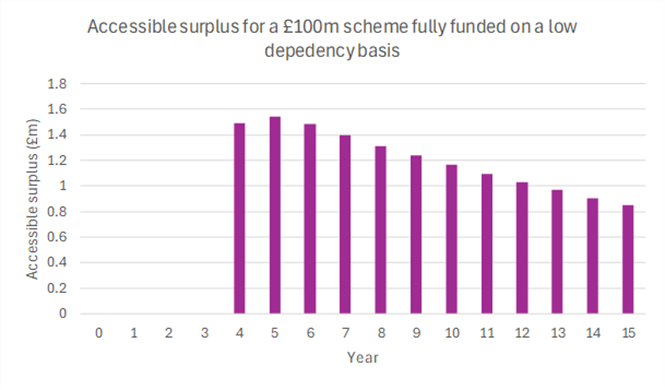

We’ve looked at a £100m scheme fully funded on a low dependency basis. One of the proposals out for consultation is that schemes could start paying out surplus above 105% of their low dependency liabilities.

The chart below shows the payout over the next 15 years for a scheme generating a return of Gilts + 2% pa on its assets (broadly in line with the return targeted by insurers). It shows payouts of c. £1m pa are realistic, equating to £15m over the next 15 years or 15% of current scheme assets. Even if some of this were shared with members or used to fund running costs, the potential value generation is significant.

What about operational efficiency?

Irrespective of a scheme’s endgame, reviewing operational processes makes sense to reduce running costs and simplify governance. For run-on, this ensures the running costs of the scheme do not become a barrier to the employer to proceeding. For buy-out and consolidators, it brings in the timescales to achieving settlement.

There are now a range of solutions on the market that use technology and automation, and leverage economies of scale across a book of DB schemes, to reduce costs and simplify governance. We’ve seen costs reduce by 30% with the adoption of these solutions.

Top tips for employers

- Review your DB endgame – fundamental changes over the last year mean your best option may now have changed.

- Employers with larger balance sheets, already managing other financial risks, should consider run-on to turn their DB scheme into an asset rather than a liability.

- Employers with smaller DB schemes should monitor developments with the PPF’s public sector consolidator as this should be live from 2026 and could be a lower cost than buy-out.

Want to discuss?

Contact us one of our experts if you’d like to discuss the options for your DB scheme.